I recently met up with an old school buddy of mine in Miami. Steve wasn’t born with a silver spoon in his hand. He rose from the ranks of the lower middle class to become a successful businessman. He started in software sales but eventually started his own company to outsource sales staff for software startups.

He was making good money, but he said something was missing. He was working too many hours, and although his income had increased – besides the occasional vacation – he was spending less time with his wife and kids.

Our conversation eventually turned to what I was doing, and he asked me numerous questions. Mainly, he wanted to know how I had time to do many things I loved. He was envious of my time. Then, it was my turn to ask him some questions. I asked him how he was spending his money and about his investments.

He said that as he made more money, his bills got bigger – bigger mortgage, car loans, and credit card balances. He put aside a little here and there to put in traditional investments or whatever people were buzzing about.

When he quit his job and started his own company, Steve just rolled his 401(k) over into an IRA and kept with “safe” investments like ETFs and mutual funds. Once in a while, he would dabble in crypto, NFTs, or meme stocks, but he admitted those were mostly gambles and that he typically lost on those bets.

Steve’s investment mindset sounds typical, right?

It’s the typical middle-class mindset/approach to money and investing, and if Steve doesn’t change this mindset, he’ll always be stuck trading time for money.

I’ve seen Steve’s situation over and over before. As his income grew, his wealth did not. His level of financial literacy was stuck in the middle-class mindset.

As Steve upgraded his income, his investing mindset was what he should have been upgrading. Instead, he was upgrading his possessions and toys with his newfound income. Steve is the poster child for what separates the middle-class from the ultra-wealthy. While the middle-class collect toys with their money, the ultra-wealthy collect more money. In other words, they put their money to work for them to buy back their time. Wealth is not having toys; it has time.

What separates the ultra-wealthy investing mindset from the middle-class?

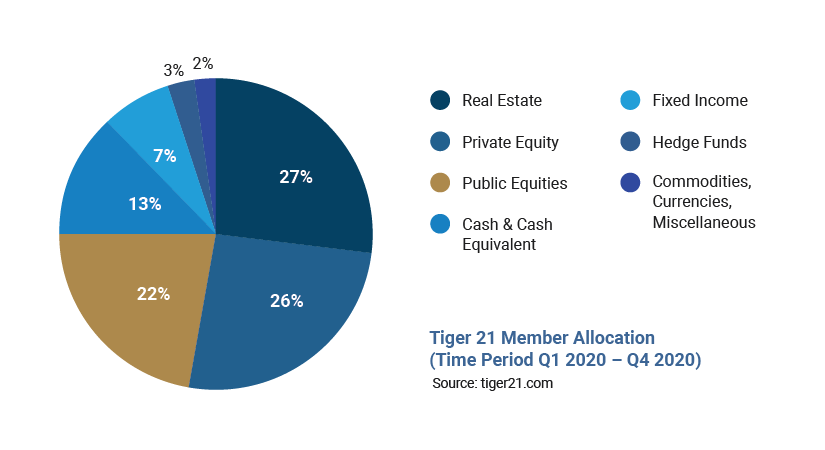

While the middle-class allocates a majority of their portfolios to traditional investments like stocks, bonds, and all of the traditional subset of investments like ETFs and mutual funds, the ultra-wealthy allocate a majority of their portfolios to alternative investments like investments in private companies (private equity) and real estate.

In hard numbers, the ultrawealthy allocate more than 50% of their portfolios to alternative investments, while the average retail investor allocates less than 5%.

If you want to know where the ultra-wealthy invest, look at the members of the ultra-wealthy investing network Tiger 21 (minimum $50M in investable assets to join).

Why alternatives?

Because alternatives offer the ideal investing benefits/components for building wealth – cash flow, appreciation, tax benefits, recession buffer, and inflation hedge.

The middle-class epitomizes “average” – average income, average home, and average investment mentality. The ultra-wealthy stand apart from the middle-class because of their approach to money and investing mentality.

What is the middle-class mentality when it comes to investing? The average retail investor is heavily allocated to stocks and stock byproducts.

Like most investors, they have their money in what they perceive as low risk: mutual funds, ETFs, 401(k) ‘s. Once in a while, they’ll hop on a bandwagon or meme stock or, on the advice of the watercooler crowd, buy some Bitcoin, Ethereum, or whatever crypto of the month the internet is currently buzzing about.

So, how does the average retail investor stack up regarding return on investment? Not great. JP Morgan Asset Management keeps score. JP Morgan keeps a rolling tab on the average 20-year returns for retail investors available through its quarterly report, Guide to the Markets.

According to the latest numbers, the average retail investor has averaged a return of 2.9% over the past 20 years. According to inflationdata.com, the long-term (1913-present) average annual inflation rate is 3.1%. Based on those numbers, the average retail investor averages a loss of .2% per year investing in the stock market. That’s no formula for success.

As long as the middle-class is stuck in the middle-class investing mentality, they’ll never be able to advance to ultra-wealthy echelons.

The ultra-wealthy have time on their hands, and the middle-class work their fingers to the bone for a reason. Their investing mindset is what separates them.

While the middle-class stick to what they know and what everyone else is doing, the ultra-wealthy pursue alternative assets that offer passive income, better returns, and less risk. The good news for those stuck in the middle-class mentality is that it’s never too late to break out of it and adopt a mindset more conducive to wealth building.